Exchange Rate Pass-Around

with Matthieu Crozet and Federico Trionfetti. Kiel Working Papers, 2246, April 2023. Revise and resubmit at the Journal of the European Economic Association.

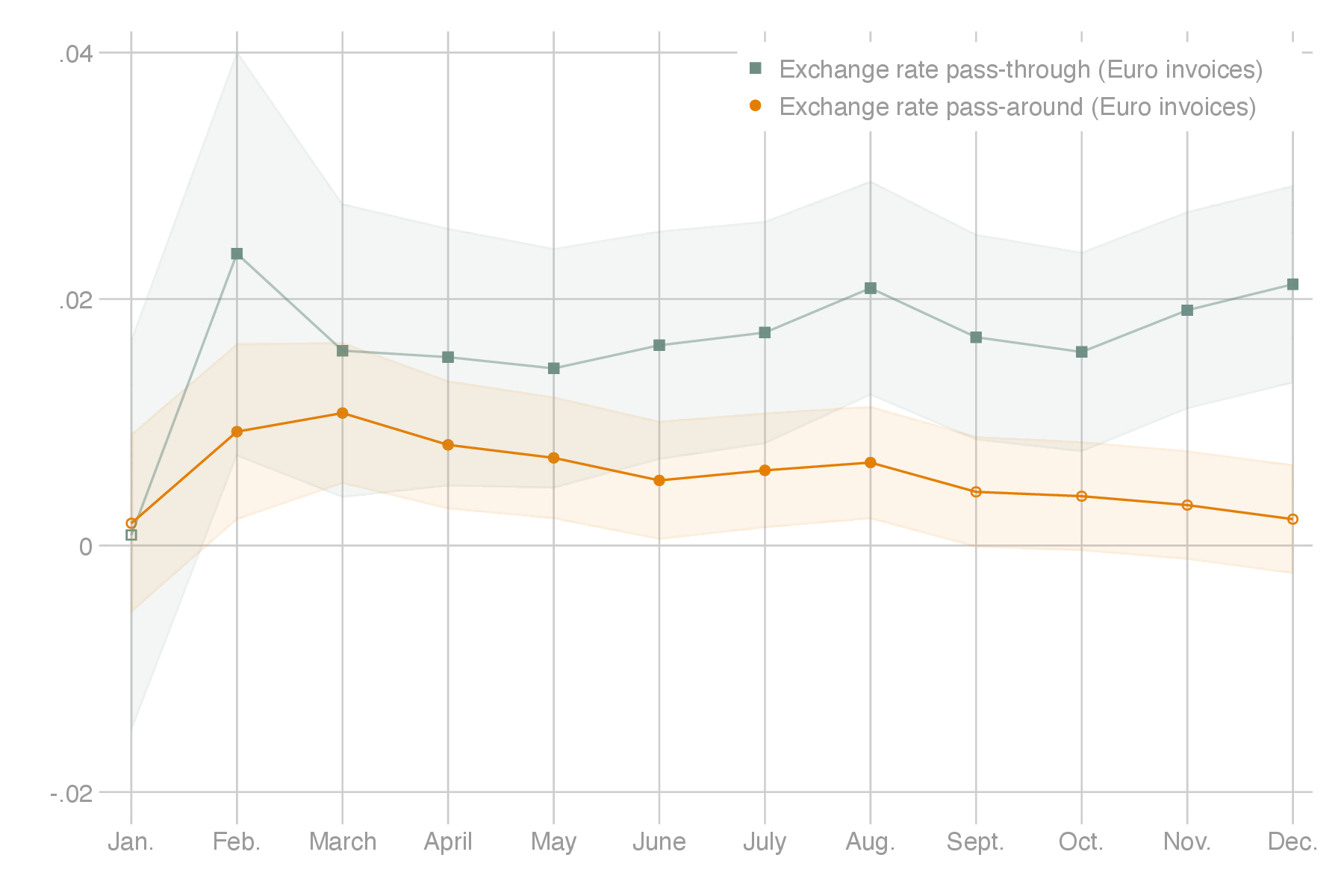

Exchange rate pass-around and pass-through over time.

In January 2015, The Swiss Franc (CHF) appreciated unexpectedly against the Euro by approximately 15%. We document a new fact: French firms that exported to both the Swiss market and the Eurozone also exhibited a sudden change in their export prices to the Eurozone. We coin this the “exchange rate pass-around” effect. We rationalise this fact with a simple model based on the endogenous decision of some firms to give up pricing-to-market and opt for single-pricing to all markets. An important implication of this finding is that single-pricing may be one of the causes of the incomplete pass-through. This mechanism has so far remained unexplored in the literature, which may have led to overestimating the importance of other factors. Based on monthly French export data, an empirical analysis confirms the existence of the pass-around. Firms directly affected by the CHF exchange rate shock increased their prices in neighboring markets by 0.8% compared to other exporters. The effect was stronger for firms with lower ex-ante price heterogeneity across markets and those with smaller trade costs to Switzerland. However, the effect was short-lived. As time passed, exporters tended to decouple the prices they set on the Swiss market from those for the Eurozone, and the pass-around effect faded.

Links & Downloads

Last updated on July 8, 2025. © Julian Hinz 1987–2025.